Your Startup or Company

Don’t wait to invest in Fintech app if you are waiting for the right moment. The world is currently going through a crucial time because of COVID-19, where the trends and the world are changing. The future of the digital world is now being understood by people and increasing demand for digital tools.

In the past, we had to wait for hours to deposit a check. It was stressful and overwhelming. The women’s world cup has gone digital. Mobile banking is now available. The rise of mobile technology is making life easier and changing traditional ways. You don’t need to wait in line for your turn. All of your banking needs can be done from your mobile phone. People are willing to pay online for convenience and ease of living. A survey has shown that the global fintech market could reach 305 billion dollars by 2025, according to estimates.

Because of the high market value, it is evident that technology used in Mobile banking has changed dramatically. To meet market growing demand and to keep up with the changing market, technologies are constantly being upgraded.

The Main Steps to Create for Your Startup or Business. 2

A few years ago, the bank was considered to be well-established if they could afford a good building. But, things have changed. The bank is now considered to be well-established, but they can only survive on the market if they offer good online services. Banks must have functional websites and mobile apps in order to survive in this competitive market. The bank’s website or mobile application must be available 24 hours a day, and it will play a significant role in the overall banking income.

8 Steps to Create a Fintech App

Step 1: Conduct thorough research

Before creating an innovative app, fintech software developers must do extensive research. They must research the latest trends, demands, and expectations of their customers to determine what they will offer in this app. Before building an app, a map must be created that clearly outlines and highlights the overall strategic plan. The guide to fintech app development is being prepared. This will define the overall look of the interface, including the identification and description of the key top features.

Step 2: Create a dynamic team

A fintech mobile app cannot be built by one person. You need a team of professionals. Effective teamwork only occurs when communication is open and clear. What are the main ideas and goals for the fintech mobile application? How would they work together? Are they familiar with the work (Fintech app)? In this area, the following experts are required:

- UI Designing

- Web developing

- Android Developing

- iOS Developing

- Software Testing

- DevOps Engineering

Step 3: Define MVP (Minimum Viable Products) scope

- It is important to define MVP (Minimum Viable Products) and what its market scope is. The following steps can be taken to achieve it:

- You should know everything you can about the product you are asking for. This requires thorough market research.

- The development team is an important part of the process. They should be contacted to discuss the most critical features.

- Prioritizing tool is recommended to highlight the most important features of selected products.

Step 4: Choose your technology stack

Technology stack? What is it? Different languages can be used to build and design apps, such as Swift for iOS and Java for Android. It will be more expensive if you have two users. Also, you cannot make two separate guides for fintech app development.

Progressive Web App (PWA) is another option. Although it’s superior to the technology stack, the downside is that you can’t use certain mobile features. Like; biometry. It is not recommended by most people.

However, there are still many options. Cross-platform app design is another way to create apps for Android and iOS users. This method is superior and can help you save up 60% on the total cost. The third option is highly recommended.

Step 5: APIs to provide basic functionalities

Features like; budgeting, bill tracking etc. These are the most important features to include in a Fintech app. These basic functions can be used if your business already offers these services.

- APIs are designed to allow end-users easy and seamless access to the entire website.

- This is why REST APIs (Representational state Transfer) are the best choice. It includes:

- For recording APIs, Swagger should be used

- Postman is the tool for testing and developing

- For the development of APIs, database solutions such as MongoDB should be used

- Security is a top concern. Data encryption and authentication must be acknowledged.

Step 6: Design UI/UX

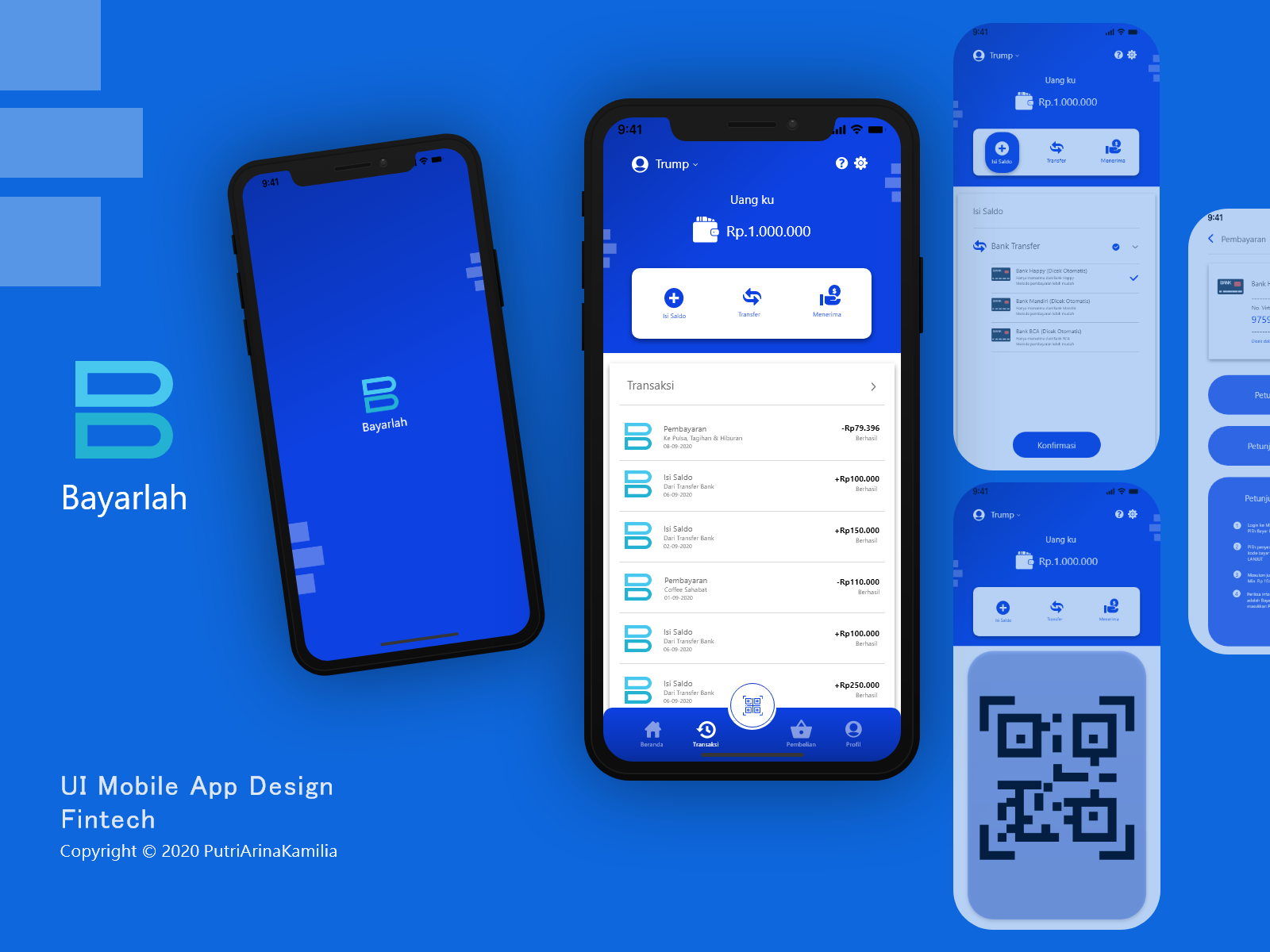

All the artistic, designing and colour features of business involved in the development of the fintech mobile application are included. The dashboard should not be too complicated and should contain only the most important features. It is important to make the dashboard user-friendly and attractive for customers. Designing is the key to grabbing the users’ attention.

Step 7: Test launch

The Beta version of the product is available in the market before the main launch. It was released in beta so that users and the public could test it. You are now ready to launch the app.

Step 8: Update the Application

What would happen if your app was not updated? The new positive features in the fintech mobile app will be lost. This could make it difficult to appreciate how valuable the update can be. This update is required because the company made many or very few changes to its features. It makes it much easier for you. You’ll still be using the older version of this app.